18 Contracts and $800K Later: The Real Estate Journey Influencers Don't Show on YouTube

It has been about a year since we started this last chapter of our real estate investment journey, our Troy project. Like Dorothy on her way to meet the Wizard, we too have encountered a vast array of characters, each with their own strength, who we need to reach the end of our journey. But unlike Dorothy, we need to sign contracts and pay all of our fellow travelers for their companionship along the way. Knowing that the legal and contractual components of our journey are fundamental to success, it seemed like reviewing everyone we signed contracts with along the way would be a helpful way of sharing one under-reported part of the real estate investment process.

Given that contracts are generally super boring and filled with language more focused on the contract than the actual agreement between people, we will breeze over all that crap. Instead, it seems much more helpful to explain what value we got from signing each of the contracts, what critical project progress it unlocks, and the ballpark costs. To continue with our build-in-public approach, we've detailed every contract we signed so far with how much we agreed to pay. The contracts a listed in the order in which they were signed.

Real estate research - $350 - While most real estate information is public, like property taxes, the quality of local schools, and crime statistics, gathering and collating all the data to analyze each potential property is much more work than it is worth, given the alternative. If you are seriously considering buying a property, paying $30 for a report that would take hours to compile is a no-brainer. That said, these reports are critical to evaluate an individual property at the zip code, city/town, and neighborhood level. These reports help quickly eliminate top-of-funnel poor investment candidates by filtering in or out entire neighborhoods and towns.

Real estate lawyer - $2,000 - Once you decide you are going to purchase an investment property, you are likely to need someone to represent you at closing. Get references and be really careful. You are hiring this person to protect you from much worse things going wrong. This contract will set you back a few thousand dollars. It depends on what you are buying and how complex your mortgage will be. In some states, New York being one, a lawyer may not be technically required by law, but having an attorney is critical in helping prevent you from signing defective documents, mostly accidental but sometimes malicious.

Environmental inspector - $1,750 - Before you buy a property or ask a bank to lend you the money to buy one, both of you should make sure that what your money is about to be used for does not have any hidden defects. Over the last century, many properties were built with or polluted by materials once thought to be inert. These tests are critical because remediating some of these materials, think asbestos, lead paint, or oil spills, can be so costly as to bankrupt the owner. This report helps eliminate bottom-of-funnel poor investment candidates by analyzing physical samples of materials taken from the property.

Structural Engineers (pre-purchase inspection) - $1,500 - For many properties that are not in mint condition, there may be areas of the building that present concern prior to purchase. Sometimes cracks, deflections, or sinking can be relatively easy to repair, and sometimes they hide a massive repair bill that can only be discovered by a professional. Later on, this engineer can help to review and sign off on all of the construction plans, recommend repair methods, and ensure that safety is maintained without overspending or over-building.

Seller - $500,000 - Needless to say, in order to buy a property, you need to sign a purchase contract with a seller. While this is not a service that will cost you money in the traditional sense, a poorly constructed purchase contract can be very costly or even devastating. Mortgage approval, environmental review, engineering inspection, and other contingencies are critical contractual terms that help you get out of the contract if the property is found to have issues.

Title insurance - $2,575 - This type of insurance protects the buyer from issues on the title or other legal aspects of the property closing. For example, if there was an old unpaid mortgage from a previous owner on the property that the title search failed to find, the insurance would pay off the old mortgage. This insurance is not cheap but can protect you from losing an amount that could be hundreds of times larger than the insurance premium. Title insurance unlocks bank mortgages as no bank would lend you the funds without one.

Property & Liability insurance - $5,200 - What can I say, it's 'Merica, people sue. In general, a mortgage without insurance is impossible. Even if you don't need a mortgage, why take the risk? One reason why real estate is a very different kind of investment 'animal' is the ability to insure your investment. Sure, it's possible to buy 'insurance' in financial markets, but how many people actually trade options in their investment or retirement portfolios? About 90% of US homes are insured while less than 10% of retail investors trade options. Property and liability insurance also unlock bank mortgages as again, no bank would lend you the funds without a policy.

Bank mortgage - $13,750 - Other than the fees to outside service providers, banks will sometimes charge upfront fees, namely points. Some banks will charge points simply for originating the loan, while others will originate a loan without fee but will offer the borrower the opportunity to buy down their mortgage rate by paying an additional upfront fee. For conforming 30-year fixed mortgages, each point of upfront fee (where a point is equal to 1% of the value of your loan) will reduce the interest rate on the loan by 0.25%. Some banks will allow the borrower to pay up to 4 points at closing (a fee equal to 4% of the loan value) to reduce the interest rate on the loan by 1% for all 30 years. We used a cash-out mortgage on another property to fund the purchase and paid the points to buy-down the rate.

Private mortgage - $0 - Unlike a bank mortgage, private mortgages can have much lower costs. Many private mortgages do not require ancillary expenses like a property survey, title insurance, or other requirements. With that said, banks require these documents to protect their investment. If you choose to take on a mortgage without some of these other expenses, be super careful. 99% of the time the survey and title search will turn up nothing, but there is a small chance of finding something that can be catastrophic. We used the private mortgage to unlock additional liquidity for our construction project.

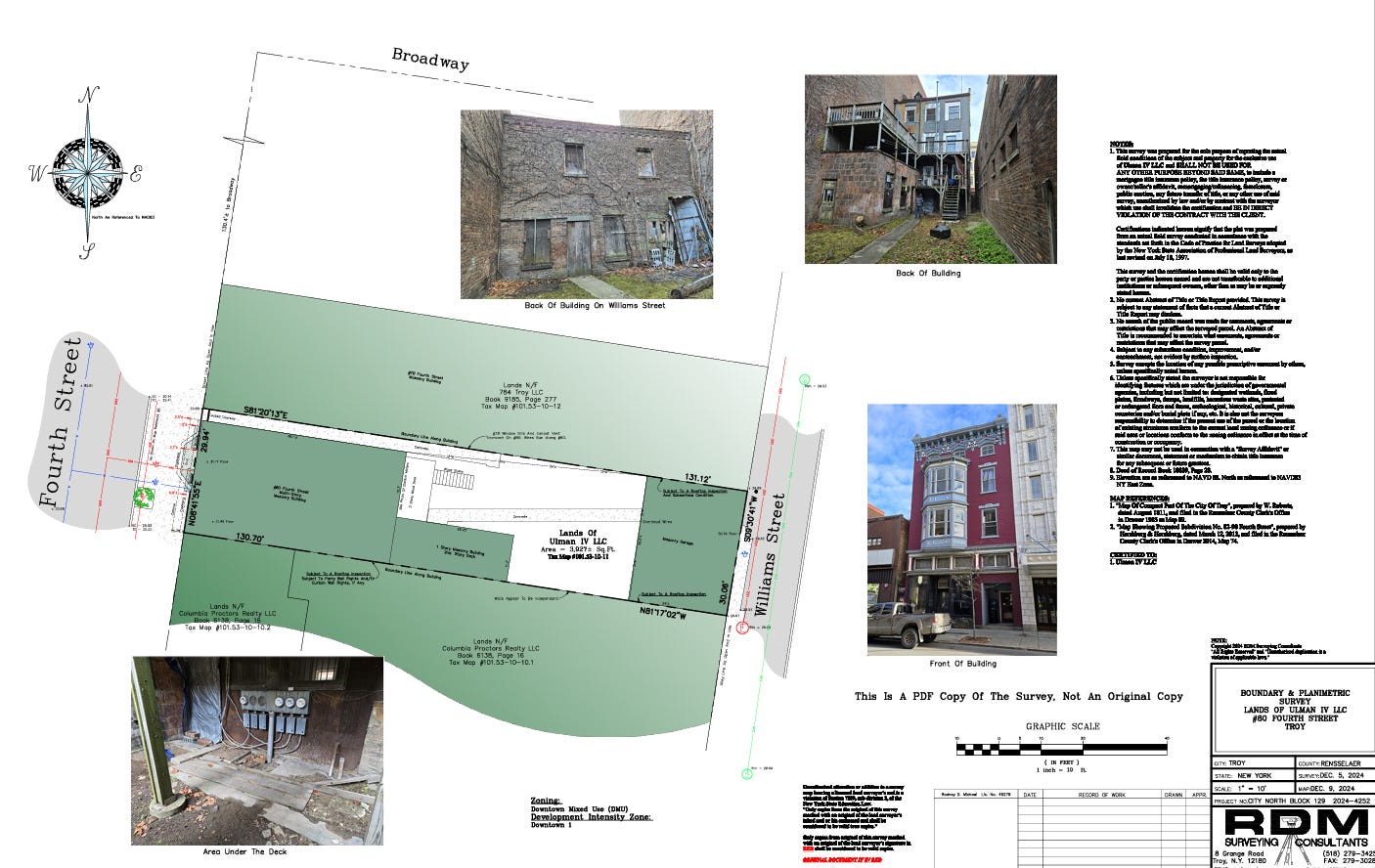

Surveyor - $1,750 - Like the environmental inspection and title search, the surveyor is yet another professional that helps to make sure that there are no hidden defects with the property you will be buying. The surveyor takes the time to specify the boundaries of the property, identify easements, ensure that no part of your building or structures encroach on a neighboring property, and that no neighboring buildings or structures encroach on your property. Surveys will be a requirement if mortgages are needed to finance your project. Here is our survey from last year.

Architect - $160,000 - Yes, that is an eye-watering number! Architects are expensive, but so are good defensive coaches on your football team. As the hired gun brought in to develop the plans, the architect puts all the plays on paper for the on-field team to execute. The architect is paid to make sure there is a clear set of plans for execution, every aspect of the project is building code compliant, to help select high-quality contractors, and to inspect the work periodically. Quality design is an intangible value critical in maximizing the value of your living spaces.

Clean out and Demolition - $40,000 - Demolishing nearly 7,000 square feet of residential property is not a small job. You have to get rid of the old to make way for the new.

Structural engineer (construction drawings) - $19,000 - Like me, you might be asking what do you need an engineer for if you have an architect? The short answer is that the architect does the overall design but relies on the engineer to do actual calculations for design components, to ensure safety, stability, and integrity. The engineer specifies beam sizes and other systems required to implement the architect's design.

Sprinkler engineer - $4,000 - Buildings over a certain size will always require a sprinkler system. Like the structural engineer, the fire protection engineer specializes in answering critical safety questions about the capacity and capability of the sprinkler system. How much water supply is needed? How big should the pipes be? How many sprinkler heads are needed and where? The sprinkler engineer needs to submit and sign off on the plans in order to get certification from the city.

Construction liability insurance - $5,100 - Acting as your own general contractor seems scary, but in essence, you are just hiring others to do the work. Since construction is taking place, there are myriad new ways for people to get hurt (or even killed) by accident. These accidents are not covered by a property liability policy. Most importantly, any construction in New York State will require a property liability policy in order for the construction permit to be issued. Pay extra attention when selecting these policies.

Sewer main plumber - $21,000 - Underground services are the first step in progressing the project. Specific installation details are of critical importance in this contract as repairing these services after the job is completed is a contractor's "unforgivable sin." The small details in this contract are particularly important as there are many shoddy ways for installers to cut corners that will pass inspection but cause headaches and increase operating costs in the future.

Window restorer - $30,000 - Historic windows are essentially antique furniture; you don't just get a guy to sand them down and refinish them. Expertise is needed to deal with the variations in construction techniques, repair techniques, wood species, and historic requirements. In a historic district, a restoration expert provides the certainty that investments are made in accordance with the historic regulations and provide a significant cost savings when compared to historic window replacement.

Project estimator - $950 - Knowing what a project should cost is one of the most important and difficult skills to acquire. In the past, pricing projects required gathering bids from prospective vendors. Today, there are service providers that use materials and labor pricing data sets, along with your architect and engineers' drawings to produce a reliable estimate. Many contractors use these services to bid out jobs. While not required for any reason, this service is another no-brainer; it provides an analysis that would likely take an amateur like me more than one hundred hours to complete.

All of these contracts are just the beginning. There is a long line of professionals I will also need to contract with to get this project over the finish line, think plumbers, electricians, roofers, painters, masons, and many more. So, what's the big takeaway from this journey through contract-land? If you're new to property development, you might be looking at this list thinking, "Holy crap, that's a lot of contracts and a mountain of money!" And you'd be right. But here's the thing, skipping any of these contracts is like Dorothy deciding she doesn't need the Scarecrow's brains or the Tin Man's heart. Each contract serves a specific purpose in getting you safely to the Emerald City of a completed project.

The reality is that real estate development isn't just about having vision or finding the right property - it's about building a team of professionals who each bring specialized knowledge to protect your investment. Sure, paying $160,000 for an architect or $19,000 for a structural engineer might seem excessive, but compare that to the potential cost of a collapsed roof or failed building inspection that could set you back hundreds of thousands.

What separates successful developers from the ones who crash and burn isn't just capital - it's the willingness to pay for expertise when it matters. Each contract is essentially buying insurance against a specific kind of disaster. And unlike Dorothy, you can't just click your heels three times to get out of a construction nightmare.

Remember, we're already over $800,000 into this project, and we haven't even gotten to the plumbers, electricians, and other trades yet. Real estate development isn't for the faint of heart or light of wallet. But if you approach it with respect for the process and build your yellow brick road one contract at a time, you'll be much more likely to reach your own personal Oz without getting eaten by flying monkeys along the way.

Now, if you'll excuse me, I've got more contracts to sign.

If you've found value in these insights and want to continue your journey of real estate wisdom, please subscribe to The Property Alchemist.

Don't let your real estate dreams remain just dreams. Empower yourself with the knowledge and insights that can turn your investment visions into concrete reality. Subscribe to The Property Alchemist today and take the first step towards becoming a Master of Real Estate alchemy. Your next successful project is just a subscription away!