A Real Estate Investor’s 1st Decision

Have you ever scrolled through Zillow and fantasized about being your own landlord? Maybe you even dreamt about quitting your day job and living the life of a real estate mogul (who also has time for poolside margaritas). But then reality sets in — finances, legalities, and the sheer unknown can be paralyzing.

Real estate is a business like any other entrepreneurial endeavor, it takes hard work and commitment to get a business off the ground. Real estate is not a Wall St. investment. A successful real estate business creates real value to people in the community. You can’t sit in front of a screen and day trade your way to success.

Fear not, my friend! Real estate can be an incredible path to financial freedom, but it’s a marathon, not a sprint (and definitely not a game of chance like Wall Street). Here at The Property Alchemist, we’re sharing our journey and building a roadmap that others can follow to turn their dream into a reality, brick by brick.

Let’s ditch the stuffy jargon and talk brass tacks. Real estate success hinges on creating real value for real people — your tenants. This means investing your money strategically, not just buying a random property and hoping for the best.

Sure, you can buy a turnkey property with an attractive return and use a management company, but in the end, that is a passive investment. To make the kind of money you need, fast enough to replace your day job, you need to create real value. Creating value is about investing your money and having something worth significantly more than what you paid. If you buy a turnkey property, time is the only way to make money. But, if you buy a property where improvements or renovations will raise the rent, now we have something to talk about.

Let’s look at types of deals: turnkey, renovation, and build. Round numbers were used to make the examples easy to understand. Each type of deal comes with its pros and cons. Our example numbers may not be at all realistic in your market.

The Turnkey Trail: This is the simplest route, perfect for busy bees who want to dip their toes in the water. Imagine a charming, ready-to-rent bungalow generating a steady stream of income. Sounds pretty sweet, right? Here’s the catch: turnkey properties often come with lower returns because the groundwork is already done. Think of it like buying a pre-made meal — convenient, but not the most exciting (and maybe a little skimpy on the portions)

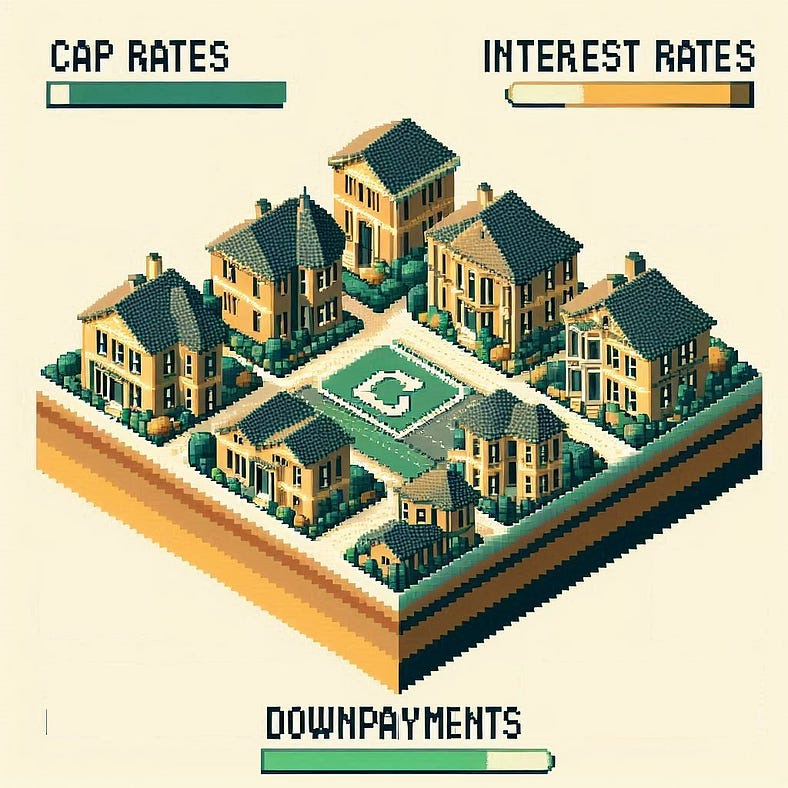

Let’s assume you buy a turnkey property with a 10% cap rate (definition). In an environment where interest rates are 7% and downpayments are 30%, a $100K investment will likely only afford a $285K property, after closing and other costs. That means you will earn 0% on the 15K of closing cost fees, a 10% return on your $85K downpayment and 3% return (10% - 7%) on the $200K that was borrowed. In this example, your year 1 return would be $14.5K in annual free cashflow and approximately $2.1K in principle pay down. That’s almost 17% annualized return, likely to grow 0.5% points per year.

Seems too good to be true? It is. High cap rates always hide neglected repairs, there is no free lunch. Yes, you will have a 17% return, until you have a leak, a furnace breakdown, or a major roof repair. In the early years, unforeseen major capital improvements like a new roof or furnace can wipe out an entire year’s worth of profit.

The Build Boulevard: Ever dream of constructing your own empire (or at least a sweet apartment building)? Building from scratch allows you to maximize profits and create brand new, high-demand rentals. The potential rewards are big, but so is the commitment. Building takes time, expertise, and a healthy dose of patience. Think of it like baking a souffle — the payoff is incredible, but one wrong move and the whole thing can fall flat

Let’s consider buying a lot and building. The basic reasoning is that building will be cheaper than buying and leave you with brand new product and bonus equity for your efforts. While profits can vary wildly by market, a few studies reported that builder’s margins were about 20%. That means new construction comparable to our first example would likely generate a yield closer to 20%, once the project is built and the units are rented. Sure, the real number is lower once you average in the fact that you get 0% while you are building. But, the real value here is that you get a 20% equity bonus once your tenants move in and everything on the property is brand new. That means you are very unlikely to need a new furnace, roof, or any other major expense in the coming years.

This path is the hardest, and for good reason. If you only have $100K, you will need a construction loan to complete the project. But after you are done with the project, if a bank will lend you 80% of the appraised value, you can get all of your initial investment back out and use the cash to do it all over again.

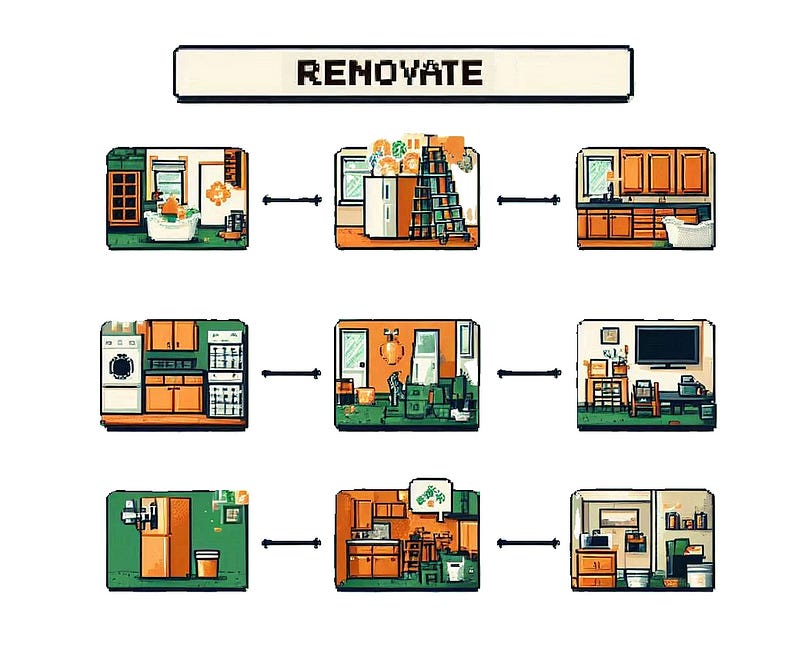

Third, are the opportunities that lay somewhere between the turnkey and the ground up build. Sometimes a building needs a total gut and sometimes just a fresh coat of paint, refinished floors, and updated appliances. The difference between the two can be dramatic. Moreover, renovations can require permits and permissions, which can themselves be meaningful challenges. For example, in many municipalities, permits require environmental testing. So, if you apply for a permit and fail an asbestos test, your entire plan needs rethinking. The most challenging part of this strategy is facing the unknown once the walls are open and critical repairs are discovered.

The Renovation Road: Feeling a little less adventurous? The renovation route lets you unearth hidden gems and transform them into income-generating masterpieces. From a light touch to a full gut, sometimes all it takes is a fresh coat of paint, updated appliances, refinished floors, and — voila! — you’ve got a property that commands higher rents. But beware, renovation road can be full of unexpected detours. Permits, hidden repairs, and environmental surprises can lurk beneath the surface, so be prepared to buckle up for the ride.

Returns for this strategy can be highly variable, since the capital investments are too. Key to profitable execution is the ability to find properties where the post renovation value is more than the property’s cost and renovation investment. This strategy is all about negotiating down the price of a property in need of improvement and hitting project budgets. For this strategy, we generally expect a 50 % to 100% equity increase on our renovation investment. In other words, we target properties where a $100K investment will result in a $150K-$200K increase in the appraised value of the property.

No matter which path you choose, remember: success is all about playing to your strengths. Do you love the thrill of the hunt and the challenge of a fixer-upper? Maybe the renovation road is calling your name. Or perhaps you’re a whiz at planning and budgeting, making the build boulevard a perfect fit.

Here’s the real magic: by choosing your strategy upfront, you become a master of “just say no.” Not every property will be a good fit. Having a clear plan will help you filter out the duds and focus on deals with true potential. This way, you’ll be well on your way to becoming a real estate rockstar, margaritas by the pool fully optional (but highly recommended).

So, are you ready to unlock the secrets of the real estate alchemist? Stay tuned for our next adventure, where we’ll delve deeper into the nitty-gritty of finding your first perfect property!