The Brooklyn Exodus: Finding Gold in Forgotten Cities

Buckle up, fellow real estate alchemists! There comes a time in every investor’s journey when your trusty market turns into a golden goose you can no longer catch. For us, that’s the tale of our home turf, Brooklyn.

Picture this: We kicked off our adventure with a four-family fixer-upper screaming for a total gut job. Back then, the house price was big, and the reno price was large. Fast forward to Brooklyn 2024, and holy smokes! Property prices, construction costs, and interest rates have skyrocketed, turning every single-family rehab into a million-dollar circus act. We’re talking gargantuan house prices and enormous reno costs that would make your wallet weep. The customer base? It used to be teachers and firefighters, but now it’s all software wizards and Wall Street warriors. Talk about a market metamorphosis!

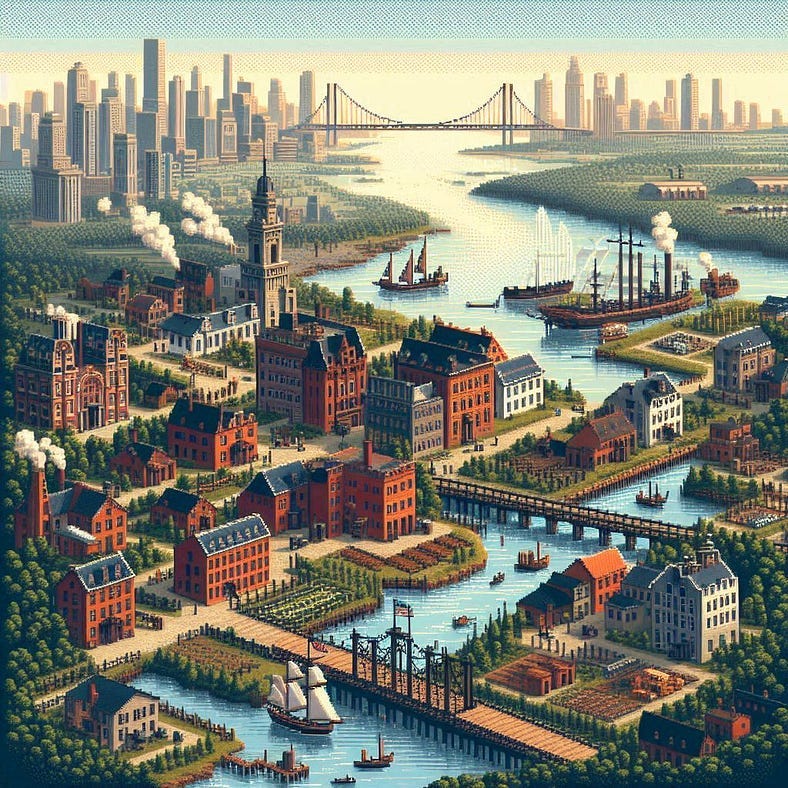

But fear not, intrepid investors! We set out on a quest to find the next Brooklyn. Spoiler alert: the Northeast is bursting with cities and towns that share a similar backstory. These ever-growing hubs of 18th and 19th century industry, powered by the wealth of the American heartland, once funneled their economic might across the Great Lakes, down the Erie Canal, and along the mighty Hudson River.

Even though our home market had outgrown our wallets, our existing properties were still churning out profits like a well-oiled machine. Armed with proof that our strategy works, we donned our explorer hats and set out to find new territories ripe for our Midas touch. We’re talking places poised for explosive growth in the coming years. So, we sharpened our pencils and defined the secret sauce of our strategy:

Walkable neighborhoods: We’re targeting upper-middle-class urbanites craving that car-optional lifestyle.

Social infrastructure: Think parks, hospitals, schools, universities, and public transit — the bread and butter of prime urban living.

Character and surroundings: People go gaga for beauty! Stunning architecture and picturesque neighborhoods are like catnip for tenants.

Economic diversity: Thriving local businesses? That’s music to our ears!

Good bones and tattered clothes: Remember, painting is a breeze, but fixing a foundation is a nightmare. Beware the money pit!

Local development: If you see nothing, do nothing. Other development projects are like a neon sign saying, “Opportunity ahead!”

Drivable: We’re keeping our investment properties within a comfortable road trip distance.

Now, onto the treasure hunt! We fired up our arsenal of real estate apps — Zillow, RedFin, CREXI, and Loopnet — and created a custom search that would make Sherlock Holmes proud. Our hunting grounds? An area bounded by Hartford CT, Albany NY, Syracuse NY, and the Lehigh Valley in PA.

Here’s the kicker: We usually have to sift through about 50 listings to find one gem worth investigating further. For that diamond in the rough, we’re evaluating four critical parameters:

Decrepitude: It’s a delicate dance between expensive renovation and catastrophic damage. Where others see danger, we see opportunity!

Phaseability: Can we break this project into bite-sized chunks to speed up our time to revenue?

Scope and Budget: Is there enough moolah in the kitty for the needed renovations?

Profitability: Time to channel Warren Buffet and model rents, interest and expense!

To keep our real estate investment flywheel spinning, we need to build equity and have cash for every deal. If we can build way more equity than the cash we invested, we can pull a little financial magic — borrow our initial investment back with a mortgage refi and do it all over again. It’s like finding the real estate equivalent of the Philosopher’s Stone!

Now, you might be thinking, “Aren’t you putting the cart before the horse by picking properties before communities?” Plot twist: It’s our secret exploration tool! By focusing on properties first, we stumble upon hidden gem communities we’d never have considered otherwise. That’s how we ended up eyeing a 30,000 sqft 1870’s bank turned apartment building in Mount Carmel, PA — a “city” of just 6,000 souls!

Once we’ve got our hit list of potential goldmines, it’s time for the grand tour. We’re talking thorough site visits and walkthroughs, where we’re on high alert for:

Outside, Basement, and Roof: Deal-breakers love to hide in sneaky old oil tanks, asbestos siding, insulation, and wet foundations.

Floors, doors and windows: We’re playing “Spot the Crooked.” Settling or bowing is a no-go.

Workmanship: Half-baked fixes outside the walls usually mean there’s a horror show lurking inside.

Hidden upside: We’re always on the lookout for unused spaces we can alchemize into rent-generating gold.

You might be wondering, “What about the apartment interiors?” Here’s the deal: We’re trying to sniff out those hard-to-fix and hard-to-price defects first. Sure, slapping in new kitchens and bathrooms directly translates to better rents. But fixing a leaky basement or settling foundation? That’s a whole different ballgame. We’re after properties where our money will work harder than a caffeinated squirrel, maximizing the rent our future tenants will gladly fork over. Remember our mantra: good bones, tattered clothes!

Now we’re at the nitty-gritty of deal-making, folks. From here on out, we start shelling out the big bucks for engineering inspections and attorney fees. At this stage, we’re only pursuing deals we’re serious about — like, put-a-ring-on-it serious.

And that’s where The Property Alchemist team finds itself today! For the past few months, we’ve been working our process like mad scientists, and it’s led us up the Hudson to the fair city of Troy, NY. We should be closing on our next deal in the coming weeks, so stay tuned! Our next post will either be titled “How the Deal Fell Apart” or “How the Deal Came Together.” The suspense is killing us!

So, fellow alchemists, let’s see how this adventure unfolds. Will we strike gold in Troy, or will it be back to the drawing board? Either way, we’re in for one heck of a ride!