The Insurance Trap That Could Sink Your Next Investment

A Real Estate Investor’s Guide to Avoiding Contractor Liability Landmine

Property and liability insurance are your financial shield in the litigious and pugilistic forums of our legal system. That's a lot of big words to say you need insurance because of possible lawsuits. Although the role of insurance is an undeniable benefit to property owners, having bad insurance or worse yet, no insurance, can leave a business owner feeling like they just swam naked across the Amazon River trying to avoid crocodiles, electric eels, and piranhas. You might make it to the other side of the river unscathed, but if you do get caught midstream, you will likely find yourself swimming with the fishes, both metaphorically and physically.

While licensing and insurance go hand-in-hand, I am assuming you will only hire licensed contractors. I’m not going to bother writing a whole post about it, I will just say this: don’t hire unlicensed contractors, period.

If you have not worked in the insurance business or a similar field like finance, shopping for insurance and reading policies sounds about as much fun as having your 12-year-old nephew try to teach you how to play Magic the Gathering. (As a proud nerd, I have owned Magic cards since '94.) Understanding what a 'good' insurance policy looks like for you sometimes feels like trying to solve calculus problems. And that is precisely why there should always be a professional involved, an insurance agent or broker. I am a real DIY kind of person, but for me, researching and managing your own insurance is a huge undertaking. Knowing enough to make sure that you are getting the right product from a broker requires a lot of effort, let alone enough to actually make such significant buying decisions.

As a real estate investor, you will inevitably hire contractors or vendors. The insurance they carry extends beyond immediate job site injuries to include property damage claims involving neighboring properties or tenant belongings. Another valuable aspect of this coverage is the completed operations protection, which continues long after the contractor has finished their work. This safeguards investors against claims stemming from faulty workmanship that manifests later, such as electrical problems that cause fires, plumbing issues that lead to water damage, or structural defects that result in injuries. Lastly, the contractor's professional liability coverage adds another layer of protection by addressing errors in professional services or workmanship that result in financial damages. This becomes particularly important in complex renovation projects where design decisions or installation mistakes can have far-reaching consequences.

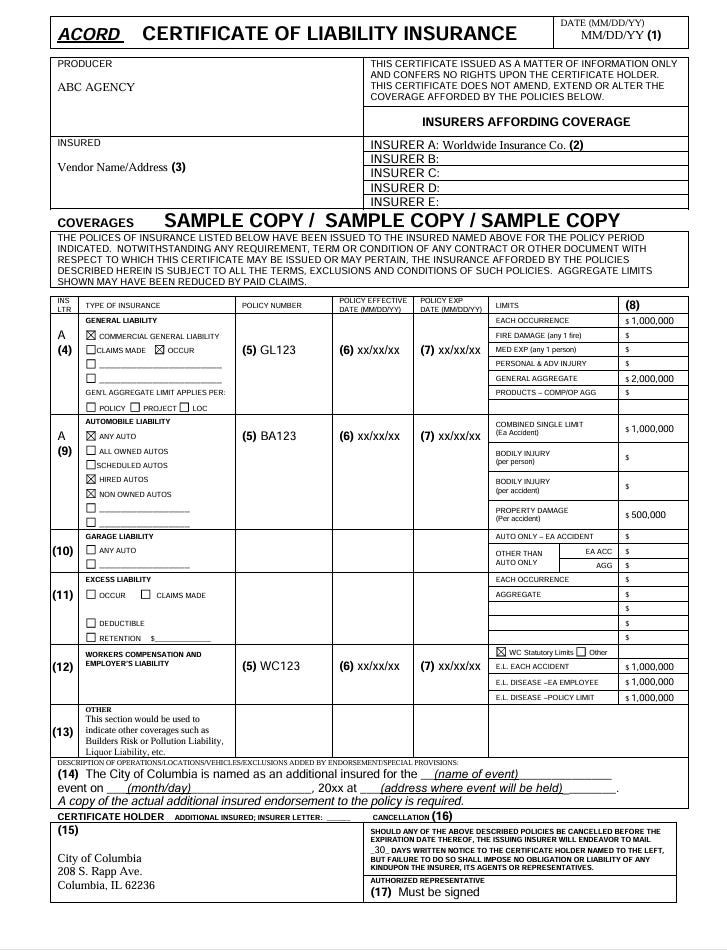

Unfortunately we live in a world with too many hucksters and cheats. So, not only do you need to make sure that vendors have the right kind of insurance, you also need to make sure that they are not lying to you about having the insurance. Real estate investors that have been through the fraud wringer know that an ACORD certificate is good, but in the days of AI and easy graphics editing, the certificate is not proof but rather just directions for how to actually get the proof.

Real estate investors face multiple liability exposures from a contractor's work including contractor employee accidents on their properties, tenant injuries from defective conditions, and environmental contamination. Each type of liability requires different insurance coverage to properly protect your assets. Policy selection should always include careful review of the policy's areas of coverage.

Contractor Liability Insurance protects you when hired contractors damage your property, injure third parties, or cause problems during work. This insurance must be carried by the contractors you hire.

Workers' Compensation Insurance is coverage required for employers. Usually property investors encounter this type of insurance when hiring contractors and vendors. If you hire employees directly, workman's comp protects owners when employees (including contractors' workers) are injured on the job site, covering medical expenses, lost wages, and disability benefits while shielding you from lawsuits. Generally, if you hire a company to provide the service, they are obligated to carry workman's comp. Always verify contractors carry both general liability (for property damage and third-party injuries) and workers' compensation before they step foot on your property, because without proper contractor insurance, their mistakes become your expensive problems.

Verifying coverage is an issue insurance companies have faced for so long that they created an industry standard solution, the ACORD certificate. The ACORD certificate along with the Association for Cooperative Operations Research and Development (ACORD), a nonprofit insurance industry standards organization, were created in the 1970s. The organization and certification emerged from a recognition that the insurance industry needed standardized forms and data formats to improve efficiency.

An ACORD certificate is a standardized one-page document that summarizes a contractor's insurance coverage, showing their general liability, workers' compensation, and other relevant policies with coverage amounts and expiration dates. Real estate investors should demand these certificates from every vendor before work begins because it's your only way to verify the contractor has adequate insurance to cover potential property damage, worker injuries, and third-party claims that could otherwise become your financial responsibility if something goes wrong on your project.

When you get an ACORD certificate from a vendor, trust but verify. Their insurance is in place to protect you from their stupidity. Failing to verify the certificate will only hurt one party in this deal, you. Start by checking the dates in the document. Here are the key data points to look for:

The certificate issue date should be recent and the policy effective and expiration dates in sections (7) should cover your entire project timeline.

Confirm that section (3) shows your contractor's exact business name and address, as any discrepancy could void coverage if something goes wrong.

General Liability in section (4) is your primary shield against property damage and injury claims. Ensure "OCCUR" (occurrence) is checked rather than "CLAIMS MADE" for broader coverage.

Verify "EACH OCCURRENCE" limit shows at least $1 million.

Verify a $2 million "GENERAL AGGREGATE" limit.

If contractors are driving to your property, Auto Liability in section (9) should show "ANY AUTO" coverage with at least $1 million combined single limit.

For contractors with employees, Workers' Compensation in section (12) must display "WC Statutory Limits" to protect you from workplace injury lawsuits.

Section (15) should list you, or the company that owns your property, as the certificate holder, ensuring you'll receive cancellation notices.

Most importantly, in section (14), your name or property management company should be specifically listed as an "additional insured," which extends their coverage to protect you directly.

Most importantly, don't just trust the certificate at face value. Call the insurance company listed in section (2) to verify the policy is active and that you're properly named as additional insured. Many investors skip this verification step and discover too late that certificates were fraudulent. Remember, while the certificate states it "CONFERS NO RIGHTS" on its own, your actual protection comes from being properly named as additional insured on the underlying policy, which this certificate should reference but cannot replace. Fake or expired certificates are surprisingly common, and a quick phone call can save you from discovering your "insured" contractor actually has no coverage when something goes wrong.

The harsh reality is simple: if your contractor doesn't have proper insurance, YOU ARE THEIR INSURANCE! Every time someone gets hurt on your property, every time they damage something, every time their shoddy work causes problems months later, guess who gets sued first? The property owner.

Yes, demanding ACORD certificates and making verification calls adds friction to your contractor relationships. Some will grumble about the extra paperwork. A few might even walk away from your project. Let them. Any contractor who balks at proving they have insurance is exactly the contractor you don't want touching your property. Don't learn this lesson the expensive way. Make insurance verification as routine as checking references.

Trust me, the ten minutes you spend verifying insurance today could save you years of legal headaches and financial devastation tomorrow.

Ready for more insights from the field? I've made the expensive mistakes so you don't have to. Subscribe to get weekly strategies, real numbers, and unfiltered lessons from 25+ years of actual deals. No theory, no fluff—just lessons learned and what actually works when your money is on the line.

A lot of great advice here! Insurance is better to have and not need than need and not have. To that point, there is a HUGE difference between Full Replacement Coverage and Actual Cash Value.

When I bought my first two properties, on the same street that the author’s upstate project is on, the difference in monthly premium between Full Replacement and Actual Cash Value was about $150 per month ($300 instead of $150).

When a woman blew up her kitchen cooking methamphetamine and destroyed four buildings (two belonging to me) the insurance company paid out more than 3x as much with the full replacement coverage than they would have if we were only insured for the actual cash value of what was lost.

With that said, your contractor’s insurance protects you from the errors that all humans are prone to making, not just their “stupidity.”

As a contractor, I wish many times that I had asked a customer for references from other contractors they have hired in the past, solely to make sure that the customer has a history of paying on time and being fair.

This too would be a form of insurance to protect you against a client’s greed and proclivity to engage in unfair business practice.

Surely this may add some friction to your customer relationship, but clients who balk or walk away may not have been worth doing business with in the first place.

And ironically the clients with the greatest ability to pay also tend to be the ones most likely to not pay or withhold part of a final payment.